- Breeze FSM

- 0 Comments

- 1176 Views

Winning a competitive advantage becomes more critical in today’s fast-moving business scenario. Businesses the world over, particularly in the dynamic Indian market, have begun to use Sales Force Automation, or SFA, to manage their sales activities more effectively. This will help reduce manual efforts in carrying out administrative tasks and thus boost your productivity level. But the question is, how will you know whether your investment in SFA is worth it? That is where calculating the Return on Investment becomes imperative. Let’s find out how you can calculate the ROI of Sales Force Automation and get a clear picture of the actual worth for your business in India.

What is Sales Force Automation?

Understanding SFA

Sales Force Automation, SFA, in general, is software tools that automate and improve many aspects of the selling process. With their aid, one can manage customer interaction, track sales-related activities, anticipate sales, and do much more. By reducing manual workloads, SFA tools will facilitate your sales team to focus more on sales and less on administration-related activities. Most companies in India serve a very heterogeneous customer base spanning a vast geographical boundary area. In such markets, SFA becomes highly efficient and effective.

Investing in SFA may sound like a huge decision, but the advantages are pretty clear: Salesforce reports that companies using SFA tools realize a 29% increase in sales productivity and a 34% improvement in forecast accuracy. For businesses in India’s highly competitive and diverse market, these SFA tools help sales teams utilize more time for closing deals instead of administrative tasks, thereby driving more revenue and higher market reach.

Calculating the Return on Investment

Why ROI Matters in the Indian Context

The calculation of ROI for your SFA investment becomes vital, especially in a cost-sensitive market like India. It gives you a clear picture with the help of which you may decide if your money spent on these tools is bringing in the returns expected from them. It enables you to make informed decisions about future investments so you’re spending wiser in a country where every single rupee has to be accounted for.

Streamline, Optimize, and Succeed with BreezeFSM

- AI-powered Market Assistant

- Territory Mapping

- Activity Tracking

- Capturing and tracking leads

- Performance Insight

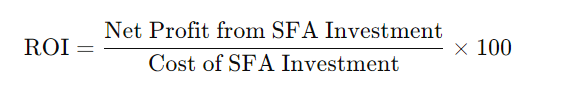

Basic ROI Formula

Here, the net profit is additional revenue gained minus the cost of tools of SFA. By computing the above formula, you will know whether this investment would be worth it for your business in India.

Steps to Calculate ROI

1. Determine the Costs

Next, list all the costs associated with SFA tools: licenses, implementation fees, training costs, and recurring maintenance costs. For India, indirect costs such as man-hours lost in learning the new system and restructuring the tool to suit local market conditions and languages must also be accounted for.

2. Quantify the Benefits

Then, identify the benefits of utilizing SFA. Consider main metrics such as increased sales, reduced time used for administrative tasks, improved sales forecasting, and improved customer relationships. Many of these benefits can be quantified thus allowing a clear-cut calculation of your ROI.

Examples of Measuring Benefits:

Increased Sales Revenue: Calculate the rise in sales revenues since the implementation of the SFA tools. For example, an SFA tool can help track the large sales force spread over several states and thereby allow for better penetration and efficiency in the Indian FMCG sector. Thus, if your average monthly sales revenues increased from ₹ 10,00,000 to ₹ 13,00,000 following the implementation of the SFA tool, the benefit accruing from increased sales revenue is ₹ 3,00,000 per month.

Sales Representatives’ Time Savings: Estimate the exact amount of time your sales representatives are saving by automating administrative jobs such as data entry or report generation. In India, where typically sales representatives cover large and diversified territories, this can make quite a big difference in productivity. Whereas they have saved 5 hours each every week on administrative tasks, that would add up to 50 from the reps combined. Attach value in respect of time saved by their wages per hour or the value of lost sales they could earn in this period.

Improved Lead Conversion Rate: As a result of improved lead management and nurturing enabled by the SFA tool, quantify how much the lead conversion rate has improved. Improved conversion rates would mean more closed deals and more revenue, hence a higher return on investment. Assume that your company improves its lead conversion rate from 10% to 15% in the first year of using SFA. Assuming that 200 leads per month are being handled and that such an uplift in conversions yields 10 more deals, calculate the average revenue per deal to measure this benefit.

Reduced Customer Acquisition Costs: Improved tracking of money spent on acquiring new customers. SFA tools streamline the sales process, lessen the time spent in cold leads, and economize marketing efforts. All these ways can result in a reduction of customer acquisition costs. Suppose your customer acquisition cost falls from ₹ 15,000 per customer to ₹ 10,000 due to better targeting and lead management. If you are getting 50 customers every month, then for every customer you acquire, you are saving ₹ 5,000, which results in a month-on-month cost saving of ₹ 2,50,000.

This means improved customer retention rates. Proper management of customers and personalized follow-up offered through SFA tools can trigger proper satisfaction and loyalty among customers. This means the churn rates are likely to reduce. If the customer retention rate improves from 70-80% and the average lifetime value of a customer being ₹ 5,000, calculate the additional revenue obtained from retaining more customers in a specific interval.

Improved Sales Forecasting Accuracy: Quantify the benefits of improved sales forecasting accuracy. Better forecasts would translate into efficient inventory management, reduction in stockouts or overstock situations, and efficient deployment of sales resources. Suppose improved forecasting cuts stockouts by 20%, with every stockout saved amounting to ₹ 10,000 in saved potential sales; then you can multiply to arrive at the total savings over a certain period.

Smarter, Faster Sales Cycle: Quantify the reduction in the length of your sales cycle. A shorter sales cycle means deals close quicker because reps can pursue more opportunities. If your average sales cycle goes down from 45 days to 30 days due to follow-ups being automated and quicker access to data, estimate the value of dealing with more deals in a short amount of time.

Factors Affecting ROI

1. User Adoption Rates

SFA tool success largely depends upon how well your team adopts the tools. And in case your sales representatives do not make full use of it, then you are not going to realize the benefits in full. In India, with many languages and regional practices, localized training and support is essential to user adoption. For maximum ROI, go for proper training and make your team understand how to use the tools to their benefit.

2. Integration with Existing Systems

Seamless integration means that data from your CRM and marketing tools well as other softwares will flow freely. The less manual entry there is, the fewer the mistakes, and the easier it will be for people to save time and be more productive.

3. Ongoing Maintenance and Support

But do not forget to add the ongoing support and maintenance costs. The SFA tools require frequent updates and maintenance so they can function optimally. Well-maintained tools minimize breakdowns so that your sales team will be productive.

Maximizing Your ROI from SFA

1. Set Clear Goals

Set clear goals about what you’re trying to achieve with your SFA tools-increasing sales, customer satisfaction, or reducing administrative work. That will provide a full perception of how to effectively measure any form of success.

2. Perform Regular Performance Monitoring

Regularly monitor the performance of your SFA tools. Keep track of key metrics such as sales growth, lead conversion rates, and time spent on administrative tasks. Thus, you can see whether it needs improvement and if you are getting the maximum value out of your investment.

3. Change Your Strategy Where Necessary

Finally, do not hesitate to make adjustments in your approach if the desired outcome is not forthcoming. SFA tools are part of a larger whole. If something is not working as it should, take some time to understand why, then implement the necessary changes so that your ROI improves.

Conclusion: Is SFA Worth Investment in India?

SFA alone can help your business in many ways, but the most important factor is to calculate its ROI to make sure every penny spent brings value. The steps are religiously being followed and the performance of every task is. Ultimately, you will know how to maximize the return on your SFA investment to attain long-term success for yourself and your sales team. Automation of processes is one thing, but the key goal is to further your sales strategy for revenue. So, keep your eye on those numbers, and you will be well on your way to sales success in vibrant India!