- Breeze FSM

- Field Sales Management, FSM

- 0 Comments

- 2881 Views

Sales optimization is a tricky affair, and it starts with optimizing your primary, secondary, and tertiary sales. So recently, when I was interviewing a sales operation head of a renowned FMCG brand in Kolkata, I asked him the secret sauce of managing such a large fleet like a piece of cake.

Interestingly, he came up with a fact that lies ahead of us always but we might not have considered much recently. He shared how their primary, secondary, and tertiary sales are sorted, and that not only brought in huge revenue but also created greater brand value, making the brand an invisible revenue generator for future sales. The strategy was for the long term, and hence I decided to share the success secret with the brands that want to see a good boost to their sales revenue this year.

Decoding Primary, Secondary and Tertiary Sales

Primary Sales: Consider a brand like Farmley. When Farmley buys raw materials for its product and sells the final product to a distributor, primary sales take place. The distributor pays the price the manufacturer charges, and that affects the manufacturer’s revenue. Through distributors, a manufacturer channels its product across India and beyond.

Secondary Sales: When a distributor sells Farmley products to retailers, secondary sales take place. The distributor generates an invoice after adding their margin to the product’s manufacturer’s charge. The revenue is reflected in the distributor’s books.

Tertiary Sales: The retailers include departmental stores and local kirana stores. When they sell the product to customers, tertiary sales take place. The product is generally sold at the MRP.

Streamline, Optimize, and Succeed with BreezeFSM

- AI-powered Market Assistant

- Territory Mapping

- Activity Tracking

- Capturing and tracking leads

- Performance Insight

How Primary, secondary and tertiary sales can play a role in creating a brand?

In the FMCG sector, the creation of a brand requires more than just strategies. It entails a consolidated effort of building rapport with retailers, incentivizing distributors, making strategic decisions based on data insights, and streamlining processes. To understand how each sales channel can influence brand building, take note of the following:

Primary sales with distributors

Building a strong relationship with distributors and adequately incentivizing them ensures that your stocks never run out. Timely replenishment of stocks guarantees that your direct source of income remains unaffected.

Secondary sales with retailers

Secondary sales involve retailers making efforts to push your products to the market by placing orders with wholesalers. For a brand, it is imperative to monitor market activities surrounding the product. Understanding consumer feedback, monthly stock turnover, and marketing tactics employed to promote the product are crucial factors in assessing its performance. This data provides insights for both wholesalers and brands.

Tertiary sales to consumers

Merchandising, in-store activities, and planogram compliance are parameters for understanding the real performance of the product. However, there’s more to it. By monitoring tertiary sales, brands gain insights into their brand equity value and understand competitor performance in the market.

Therefore, understanding these three sales channels is crucial for a brand.

What are the challenges brands face in managing primary and secondary sales?

When product moves out from the manufacturer’s warehouse to the distributor’s inventory primary sales take place but without a right too, a process cannot be created. The challenges they face are:

1. Challenges of Managing Distribution Channels

A brand expanding its reach from selling solely in local shops to also distributing through supermarkets, convenience stores, and online platforms. With each new distribution channel comes added complexity in managing inventory, coordinating deliveries, and ensuring product availability. Without effective systems in place, tracking primary sales across these diverse channels becomes increasingly challenging.

2. Absence of Protocols for Tracking Primary Sales Data

The company may lack standardized procedures for recording primary sales data, such as sales volumes, revenue, and customer demographics. Without consistent data collection methods over time, it becomes difficult to analyze sales trends, identify patterns, or pinpoint areas for improvement. For instance, without historical sales data, the company might miss out on recognizing seasonal fluctuations in demand or the impact of promotional campaigns.

3. Lack of Forecasting for Product Stock Updates:

Without accurate data on primary sales, the ice cream brand struggles to forecast future demand for its products. As a result, they may encounter stockouts or excess inventory, leading to inefficiencies and potential revenue losses. For instance, if the company fails to anticipate increased demand for certain flavors during summer months, they risk running out of stock, missing out on sales opportunities, and disappointing customers.

4. No Reporting System for Secondary Sales

The company relies solely on primary sales data without visibility into secondary sales made by dealers or retailers. This lack of insight into consumer purchasing behavior at the point of sale means the company misses out on valuable information, such as which products are selling well, which regions have high demand, and which marketing strategies are effective. For instance, without data on secondary sales, the ice cream brand may overlook popular flavors in certain locations or fail to identify emerging trends in consumer preferences.

5. Insufficient Information Leading to Higher Inventory Handling Time

Due to inaccurate or incomplete data on secondary sales, the ice cream brand struggles to forecast demand accurately. This results in either overstocking or understocking of inventory, leading to increased handling time, storage costs, and financial risk. For example, if the company overestimates demand and produces excess inventory, they may incur additional expenses for storage and disposal of unsold products, impacting their profitability.

6. Difficulty in Inventory Management

Without proper tracking of goods movement between different levels of the supply chain, the ice cream brand faces challenges in managing inventory effectively. For instance, delays in receiving inventory updates from distributors or retailers can lead to discrepancies between actual stock levels and recorded inventory, resulting in stockouts or excess inventory. This lack of visibility into inventory movement hampers the company’s ability to optimize stock levels, meet customer demand, and minimize carrying costs.

Similarly, without right technology the problem persist in managing secondary sales too:

1. Lack of Visibility in Secondary Sales During Holiday Season

During the holiday season, an ice cream brand experiences a surge in demand from retailers due to increased consumer purchases for celebrations and gatherings. However, the company lacks visibility into secondary sales at retail outlets, making it challenging to track inventory levels accurately. As a result, the brand may struggle to replenish stock promptly, leading to stockouts and missed sales opportunities during the peak demand period.

2. Difficulty in Inventory Management

Without real-time visibility into secondary sales data, the ice cream brand faces challenges in managing inventory effectively. For instance, if a popular flavor sells out quickly at retail stores, the company may not receive timely updates on stock levels, resulting in delays in restocking the product. This leads to dissatisfied customers who are unable to purchase their desired flavor, impacting sales and brand reputation.

3. Challenges with Product Stocking Management

If the company underestimates demand for a particular flavor during the holiday season, they may face shortages of that product, disappointing customers and potentially losing sales to competitors who can fulfill demand more effectively.

4. Manual Coordination Challenges with Increased Sales Reps:

If each sales rep is responsible for managing orders and inventory manually, there is a higher likelihood of errors, delays, and miscommunication. This inefficiency can lead to disruptions in supply chain operations and hinder the company’s ability to meet customer demand effectively.

5. Lack of Central Database Leading to Revenue Loss

The ice cream brand lacks a centralized database and operates with unorganized supply chain operations. For instance, if different departments within the company use separate systems for inventory management, sales tracking, and order processing, it becomes challenging to reconcile data and make informed decisions. This lack of integration and visibility can result in revenue loss due to inefficiencies, inaccuracies, and missed opportunities for optimization.

6. Impact of Poor Market Research Data on Secondary Sales:

If field reps fail to provide timely feedback on consumer preferences for flavors or packaging, the company may miss out on opportunities to tailor its products and marketing strategies to meet customer demands effectively. This lack of insight can lead to decreased secondary sales and lost revenue opportunities.

7. Effect of Poor Visibility on Trade Promotional Campaigns

If the company cannot track the effectiveness of promotional offers or incentives at the retail level, they may struggle to assess the ROI of marketing efforts and allocate resources effectively. This lack of visibility can result in wasted marketing spend and diminished impact on secondary sales.

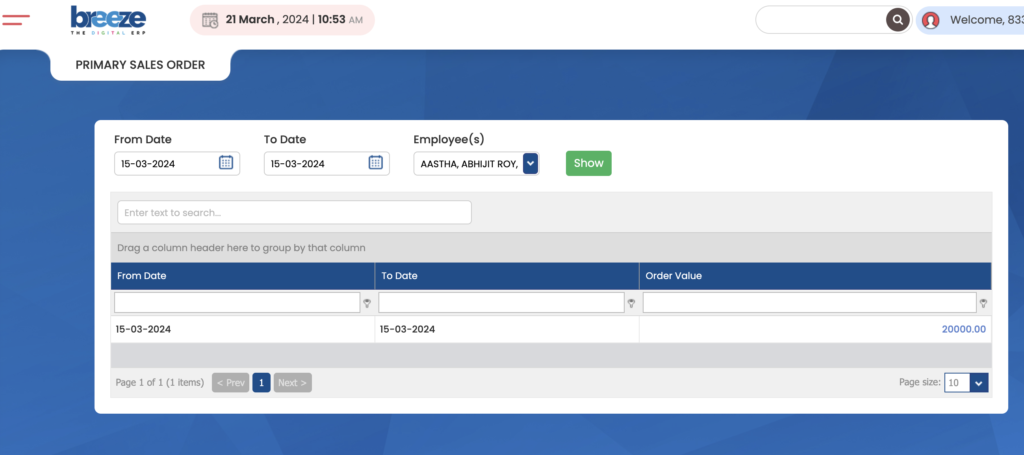

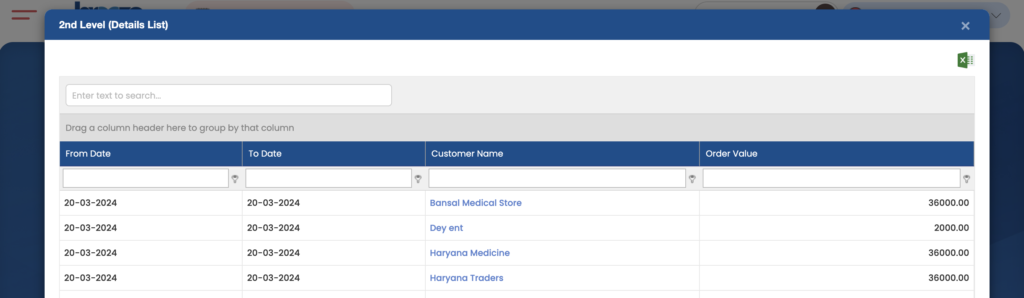

BreezeFSM brings brands, distributors and retailers together

BreezeFSM, with its simple yet scalable field sales management tool, offers a solution for brands to maintain a strong grip on sales operations. We bring every level of the supply chain onto one platform, enabling transparency at all levels. With BreezeFSM, you gain access to features such as order taking and beat planning tools, among others, to make your sales process efficient and successful. We recommend trying our demo to empower your field sales management team.